Even before this latest development, our Euro area analysts expected the bloc’s economy to slow sharply in Q3 before contracting 0.1% quarter-on-quarter in Q4, with several analysts seeing a fall in GDP over 2023 as a whole. These projections are now set to be revised down in our next forecast round.

That said, the effect on the European economy is still highly uncertain. For one, it will vary by country: Those with large industrial sectors and with heavier reliance on Russian gas, such as Germany and Italy, are the most exposed. Moreover, while Nord Stream 1 is the main route via which Russian gas reaches Europe, it is not the only one, as gas is still flowing westward from Russia via Ukraine and Turkey. The fate of these routes, together with the EU’s efforts to source alternative supply from the North Sea, the U.S. and Algeria, will be crucial in determining the extent of the upcoming supply crunch. The weather will also play an important role; a mild winter would reduce gas demand for heating.

Finally, the EU has not sat on its hands in response to the Nord Stream shutdown. Member states are mulling a range of EU-wide options, from gas price caps to a windfall tax on energy companies, and measures to reduce energy demand. Moreover, further fiscal support is to be expected at the national level. If approved, these measures will offset the fallout from constrained gas supplies to some degree. As such, while Russia’s move is certainly a blow to the EU economy, it is not yet a death knell.

Insights from Our Analyst Network

On the countries most at risk, the EIU said:

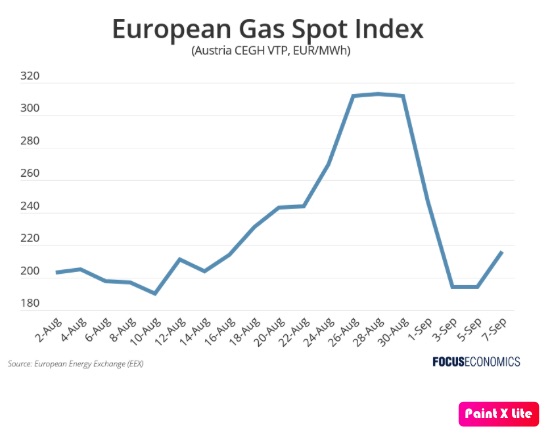

“The countries most likely to face gas shortages are Germany, Austria, Italy, the Czech Republic and Slovakia. Those countries' governments are already working to reduce demand and diversify their sources of gas, on the assumption that Russia is no longer a reliable supplier. The spillover effects will be substantial for the rest of Europe too, with external demand and confidence suffering, and inflation remaining elevated. We will revise up our forecasts for European gas prices, and the euro will be weaker against the US dollar than we had anticipated.”

On the potential economic fallout, analysts at Goldman Sachs said:

“A full shutdown […] could drive European household energy costs up by about 65% to around €500 ($512) per month, according to estimates by Goldman Sachs Research. Industries like chemicals and cement in Germany and Italy might have to cut their gas usage by as much as 80%. The euro-area economy would likely shrink by more than 2% through March 2023, with GDP in Italy and Germany declining as much as 4% and 3% respectively.”

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the opinion of FocusEconomics S.L.U. Views, forecasts or estimates are as of the date of the publication and are subject to change without notice. This report may provide addresses of, or contain hyperlinks to, other internet websites. FocusEconomics S.L.U. takes no responsibility for the contents of third party internet websites.

Si (

Si ( No(

No(